Company owners often have ambitious and aspirations, willingness to achieve big goals in order to continue building their success stories. Business owners’ decisions in diving into a new project is exciting and thrilling, yet full of risks, especially the risks of financial loss, and this is what they always approach new projects with both excitement and caution. Given these risks, the idea of a Special Purpose Vehicle (SPV) is a perfect solution for pursuing achieving business goals, and protecting current companies and assets from loss.

A SPV is a private company that is isolated financially by ring-fencing assets and liabilities, in other words, it has a separate legal personality, this is why the SPV’s creditor’s claims cannot reach the SPV’s shareholders or the related companies. Establishing a SPV is a solution that business owners need to be aware of, particularly in a trusted and flexible financial territory like Abu Dhabi Global Market (ADGM).

Why Choose ADGM for SPV Setup?

Registering a SPV in ADGM allows the registered SPV to apply for a Tax Residency Certificate from the UAE Federal Tax Authority (FTA), which allows it to access the UAE’s double Tax Treaty network. Companies that are registered in other authorities can flexibly relocate and redomicile to ADGM without liquidation or restructuring, which helps the companies to preserve the existing corporate contracts and history, while benefiting from the common law jurisdiction.

ADGM allows companies to register without the necessity of having a physical office, which reduces incorporation costs and makes it easier for non-resident investors to establish SPVs with using their Corporate Service Provider (CSP) addresses.

For a detailed overview of ADGM company setup, you can also check our ADGM Company Setup Guide.

Common Use Cases of SPVs in ADGM:

- Real Estate Investors: SPVs are commonly used to hold property assets, whether a single property or an entire portfolio. Owners can create SPVs based on their property’s location (e.g. Abu Dhabi, Dubai) or asset type (e.g. residential, commercial).

- Business families with complex structures: SPVs help families to organize their interests by sector (e.g. retails, hospitality), ownership (e.g. wholly owned, jointly owned) or geography (e.g. UAE, Kuwait, etc)

- UAE Business Owners: Individuals who hold assets in the UAE in Limited Liability Companies under their personal names, can transfer their share into a SPV. This will enhance privacy, control, and succession planning options.

The Nexus Requirement for ADGM SPVs

In addition to all the applicable licensing requirements for ADGM company setup, for SPVs, there’s a special requirement (The Nexus Requirement), where applicants must be able to demonstrate that the SPV will have an appropriate connection (nexus) to:

- ADGM or

- UAE or

- Gulf Cooperation Council (GCC) Region.

This connection can be demonstrated in several ways, including any evidence of the following:

- The SPV is owned by a UAE or GCC based private company, family office or individual.

- The SPV is holding assets that are located in the UAE or GCC Region.

- The SPV facilitates transactions that are connected to the UAE, or provides real economic benefit to the UAE.

- The SPV’s purpose includes the issuance of Securities that will be admitted to the Official List maintained by the Financial Service Regulatory Authority (FSRA), and / or admitted to trading on a Recognized Investment Exchange, MTF3, OTF4 or other licensed platform (including a PFP5) that is established in ADGM.

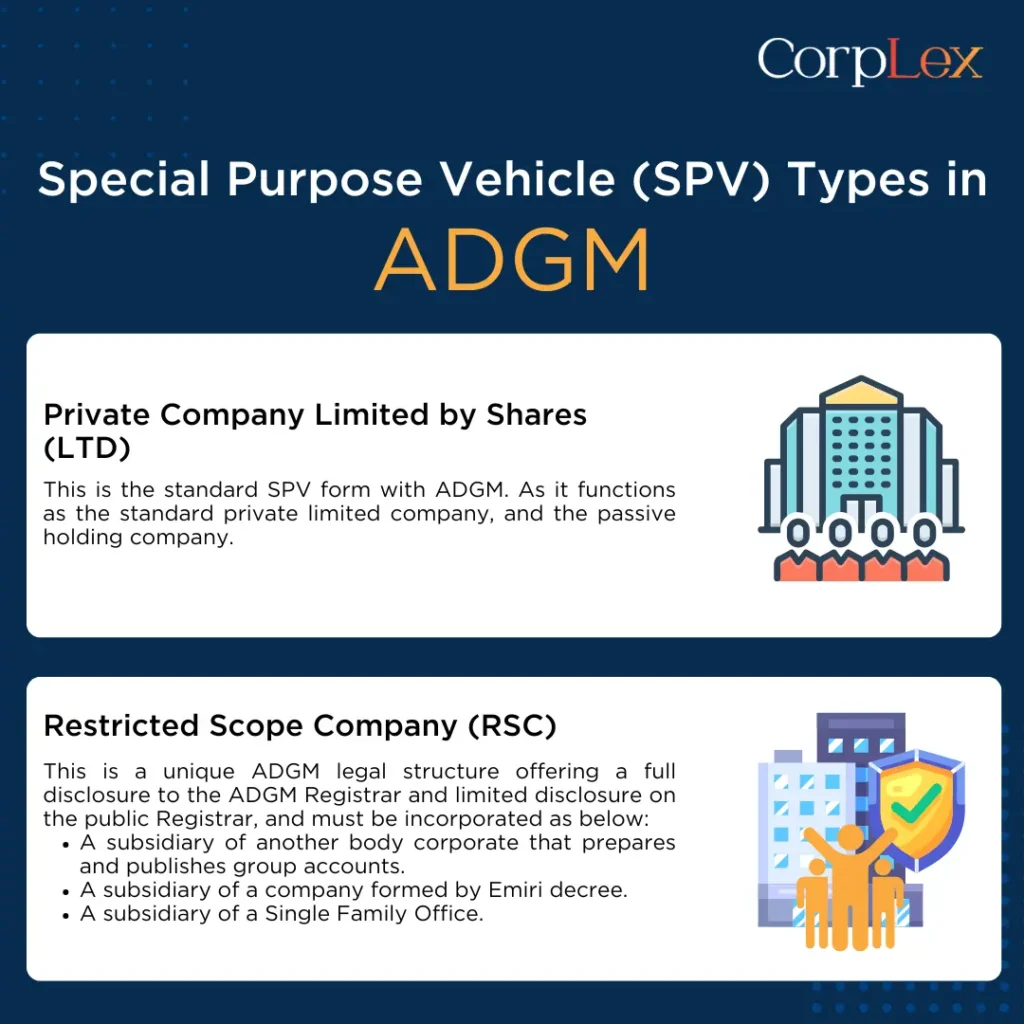

Special Purpose Vehicle (SPV) Types in ADGM

ADGM offers two main types of SPVs, created to meet several business needs in terms of structure, specially in terms of holding and managing assets, isolating financial risks, and allowing groups structuring. These types include:

- Private Company Limited by Shares (LTD)

This is the standard SPV form with ADGM. As it functions as the standard private limited company, and the passive holding company.

- Restricted Scope Company (RSC)

This is a unique ADGM legal structure offering a full disclosure to the ADGM Registrar and limited disclosure on the public Registrar, and must be incorporated as below:

- A subsidiary of another body corporate that prepares and publishes group accounts.

- A subsidiary of a company formed by Emiri decree.

- A subsidiary of a Single Family Office.

Important Notes Before Setting up a SPV in ADGM

With ADGM, Setting up SPVs can fall under one of two categories, which indicates from the start how the application should be submitted, that is “Exempt” and “Non-Exempt” applicant.

The main difference between Exempt and Non-Exempt Applicants is requiring a Company Service Provider (CSP), for Exempt applicant, a CSP is not required and can be done directly through ADGM, whilst for Non-Exempt applicants, a CSP is mandatory.

With ADGM, the payments for setting up SPV can fully be done online, and the application can be completed digitally through the online registry solution in ADGM on the website. Additionally, there is no need for the owners to personally visit ADGM, as there is no need for delivering original hard copies of any document.

SPV’s Registered Office Address

SPVs that are registered with ADGM should have a registered office address in Al Maryah Island or Al Reem Island, which can be satisfied in several ways:

- Non Exempt SPVs can use the appointed Company Service Provider’s office address.

- Exempt ADGM SPVs can use the ADGM address for its ADGM related entity or it’s parent entity that is registered with ADGM.

- ADGM registered legal entity with the licensed business activity of ‘registered office provider’ may offer registered office address to Exempt SPVs.

Required Documents for ADGM SPVs

- Articles of Association (AOA): Where either the owner can use a modeled AOA provided by ADGM, or an amended AOA, or a bespoke AOA.

- Registered office address: for Non-Exempt SPVs, a signed consent letter for provision of the registered office by the appointed CSP is required.

- Copy of the Board of directors or Shareholders Resolution.

- Copy of the passport, UAE visa page for each Signatory (UAE Residents)

- Copy of the Emirates ID/ for the Signatories which are Emiratis and GCC nationals.

- Certified Certificate of Incorporation (within the last 3 months) for each Corporate Shareholder or Director.

Cost and Timeframe

Application for reserving a name $200

Incorporation Application $400

Commercial License 1,000$

Total $1,600

Additionally, $ 700 is charged for registration inclusive of $300 Data Protection registration fee.

*Note: The above mentioned fees may be subject to changes, and are not including the professional fees charges by the CSPs.

It takes between 3-4 weeks to establish the Foundation with ADGM from the day all the required documents are delivered by the client.

Conclusion:

At CorpLex, we help clients understand the ADGM SPV setup process clearly, making sure its done with maximizing strategic benefits.

Whether you’re just starting to explore SPVs or you’re ready to launch, Contact CorpLex today for professional guidance and smooth setup.

If you’re also interested in other ADGM structures, explore our guide on Types of Companies in ADGM.

FAQs:

What is an SPV and why should I use it?

A Special Purpose Vehicle (SPV) is a private legal entity established for the purpose of isolating financial and legal risk by ring-fencing certain assets and liabilities.

Why should I set up my SPV in ADGM instead of other jurisdictions?

1. Independent ADGM Courts

2. Best-in-class independent regulatory framework

3. Access to broad UAE double tax treaty network

4. Variety of legal structures available to set up

5. Quick and easy, fully digital registration process

6. No attestation required for corporate documents

What are the common uses of SPVs in ADGM

1. Holding real estate assets.

2. Family business structuring.

3. Transferring shares from personal name to SPV for privacy, control, and succession planning.

What is the difference between Exempt and Non-Exempt SPVs?

Exempt SPVs: Do not require a Company Service Provider (CSP); can apply directly.

Non-Exempt SPVs: Must appoint a licensed CSP.

This affects how you apply and where your registered address can be.