This article prevails a practical DIFC Company Structures Comparison, highlighting each entity’s purpose, licensing authorities, and key considerations for investors.

DIFC, an esteemed international financial center traversing a big number of MEASA countries and crossing international markets from the East to the West. Such a freezone features banks, investment firms, family offices, FinTech companies, and professional service providers; all of which are just a few of the financial and non-financial entities that have made the Dubai International Financial Center (DIFC) their headquarter.

For a detailed step-by-step guide on setting up a company in DIFC, you can refer to this DIFC company formation guide.

For investors and business owners, choosing the right type of DIFC Company Structure is a crucial step that directly affects licensing, compliance obligations, and operational flexibility. Alignment with long-term goals while implementing cost-effective strategies could be done through perceiving whether an entity should be regulated, non-regulated, or structured as an PC (Prescribed Company), based on your demand.

Which DIFC Company Structure Best Fits Your Business?

The Registrar of Companies (ROC) is entitled to handle incorporation and entity registrations in DIFC. The ROC is established under Article 6 of the Operating DIFC Law No. 7 of 2018 (Operating Law).

The DFSA on the other hand – the Dubai Financial Services Authority- is known as the independent regulator of financial services within the DIFC, it’s in charge of licensing and supervising financial entities, as well as implementing AML compliance procedures. These distinctions are important when considering DIFC entity types explained and the steps required for company formation. DIFC entity types could be listed as follows:

1. Regulated Entities:

These entities are supervised and authorized by the Dubai Financial Services Authority (DFSA), and they mostly conduct financial and investment-related activities. They were defined in the DIFC companies’ law of 2018 as regulated markets, known as “An exchange regulated by the DFSA or a financial services regulator outside the DIFC.”

Examples of such entities include:

- Investment Advisory and Brokerage

- Wealth and Asset Management

- Fund Management

- Banks and Insurance Companies

Key features of regulated entities are that these entities require DFSA’s regulatory authorization application, where they decide the financial services to be carried out and apply for the correct license type before commencing operations.

They should also present a Reg-BP (Regulatory Business Plan), a focused plan explaining strategy, services, clients, legal entity structure, systems, and how the firm will meet DFSA rules. Regulated entities should also maintain capital adequacy, compliance regulations, and regular reporting standards.

An example of regulated entities could be Asset Management Firm serving global clients. For more insights on structuring investment and fund activities, see our Funds Management in DIFC blog.

Advantages vs Disadvantages:

Below are some pros and cons for regulated entities within DIFC

| Advantages for Regulated Entities | Disadvantages of Regulated Entities |

| High credibility and investor confidence | Prolonged licensing process |

| Access to the regional and international financial ecosystem. | Higher compliance and regulatory burden. |

| Suitable for investors seeking investor protection, transparency, and market integrity. | Costly process |

2. Non-regulated Entities:

Non-regulated entities are engaged in non-financial services and thus fall outside DFSA’s supervision. They are registered with DIFC ROC and are commonly used for consultancy, holding, trading purposes, or providing professional services. Some examples include law firms, corporate headquarters, family offices, and general holding companies.

The key features preclude simple and faster registration process, no DFSA approval requirement, though they must comply with DIFC Companies Law of 2018 and annual filing requirements. Such entities are ideal for businesses offering non-financial or professional services.

An example of a non-regulated entity would be a Family Office, consulting firm, or a group holding company.

Advantages vs Disadvantages:

Regulated entities and non-regulated entities share counter advantages and disadvantages as follows:

| Advantages | Disadvantages |

| Lower setup and operational costs | Cannot conduct regulated financial activities |

| Flexible corporate structures | Limited access to certain financial instruments |

| Access to DIFC’s business ecosystem and international legal framework | Restricted scope excluding investor networks |

3. Prescribed Companies:

“An PC is a separate legal entity created for a specific purpose, such as holding assets or financing a project, to isolate financial and legal risk”, as mentioned and defined by DIFC regulations. The main reasons for setting up PC are to structure assets, being passive holding entities; PCs protect against risk and prepare for wealth. Such companies are registered with DIFC ROC and commonly used by corporates, family offices, and investors for holding shares, real estate, or intellectual property.

The main characteristics of PC are that they don’t have active business operations, are mostly suitable for holding or ring-fencing assets; they are often used alongside DIFC Foundations or Trusts for estate planning, and are beneficial for succession planning, investment structuring, or financing transactions. To learn more, see our DIFC Foundation guide.

An PC’s model example is a Holding company for Real Estate or shares in UAE or abroad.

Advantages vs Disadvantages:

The table below displays a few advantages and disadvantages of SPV set up:

| Advantages of PCs | Disadvantages of PCs |

| Legally liable and tax-efficient | Limited scope of activity: Passive Holding |

| Simple compliance requirements | Subject to DIFC’s due diligence requirements, and UBO’s identification requirements. |

| Double-tax treaty access under UAE’s legislation, avoiding double taxation and offering lower tax rates. | Is not allowed to perform trading activities or provide services, thus lacks employees. |

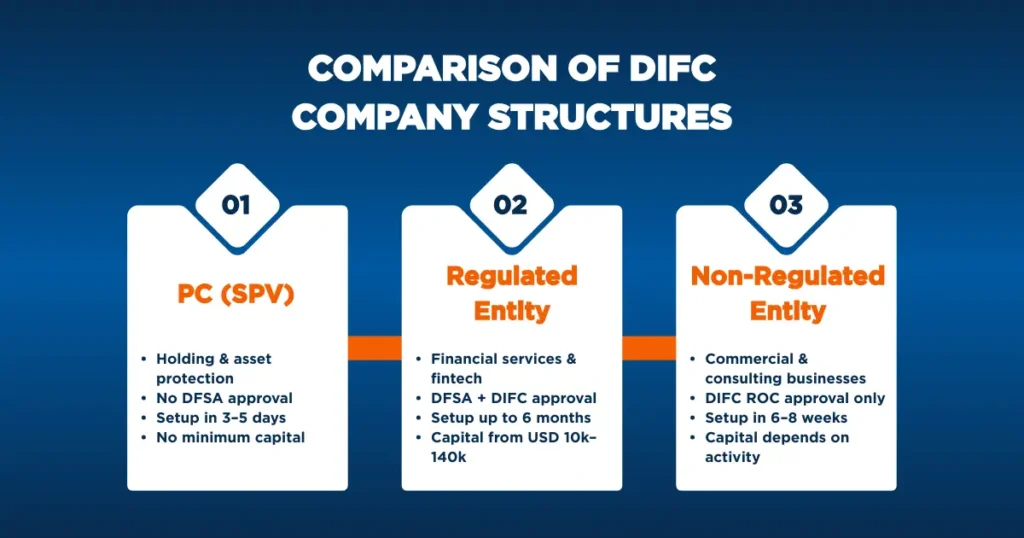

DIFC Company Structure Comparison Table

Below is a Key Comparison Table displaying the key differences between SPVs, regulated and non-regulated entities in DIFC:

| Features | PC | Regulated Entity | Non-regulated Entity |

| Regulatory Authority | DIFC ROC | DFSA approval+ DIFC ROC | DIFC ROC |

| Primary Use | Holding Structure | Financial Services | Non-Financial business |

| Licensing Requirement | ROC registration, no DFSA license approval | ROC registration + DFSA license approval | ROC registration, no DFSA license approval |

| Set up time | Initial Approval within 3 business days, then 3 to 5 days for legal registration | Up to 6 months, even more in certain cases | 6 to 8 weeks |

| Minimum Capital | No minimum capital requirement, only start-up costs. | Minimum capital is determined based on the type of license and could range from USD 10,000 to 140,000. | It depends on the package offered, some banks may require a certain minimum amount of capital. |

| Reporting Obligations | DIFCA | DIFC + DFSA | DIFCA |

| Suitable for | Holding assets, ring-fencing liability, Estate and succession planning, and owning property in designated areas. | Asset and fund management, banking, insurance, payment services and FinTech. | General business operations, commercial, consulting, or professional activities. |

Choosing the Right DIFC Company Structure

- Therefore, choose a Regulated Company if you’re providing financial services.

- Non-Regulated Company is to be chosen if you’re engaged in non-financial consultancy or holding,

- An PC if you’re focused on asset protection or structuring investments.

Consider compliance, cost, and management requirements before deciding.

Final Thoughts

In conclusion, selecting the proper DIFC entity structure is a strategic decision that can shape your long-term operational and financial success. Each entity provides a unique set of financial and non-financial benefits, since they each provide a distinctive and specific mission to fulfil.

Understanding these characteristics allows investors to align their set up visions with the realities of regulations and DIFC Company Structure Types. Consulting a DIFC-registered corporate service provider can ensure your structure meets both business and regulatory objectives from the outset.

FAQs

What is the difference between a DIFC regulated and non-regulated company?

The key difference lies in whether the company carries out financial or non-financial activities. If the company intends to provide financial services, then DFSA approval is required, otherwise it is considered a non-regulated entity.

What is a DIFC PC used for?

A DIFC PC, also referred to as SPV, is a private company structure designed for holding and isolating assets or liabilities, it is most used for holding shares, owning property, structuring wealth, and financing transactions.

Which DIFC company structure is best for asset protection?

For family succession plans and individuals seeking asset protection, the DIFC PC is a securing entity ensuring the protection of assets, compatibility with DIFC wills and trust structures, and the ability to hold global assets under common jurisdiction.

Do DIFC PCs need a DFSA license?

No, PCs are registered with the DIFC Registrar of Companies, and since they are not permitted to conduct any financial service or commercial trading activity, or hire any employees, they are not required to acquire a DFSA license.

How long does it take to set up each DIFC company type?

As mentioned in the table above, each entity requires a different timeline. While regulated entities require a prolonged process of 4 to 6 months, non-regulated entities involve faster procedures of 2-4 weeks to set up; and the PC, being the fastest process of them all, requires 5-10 working days to be established -if all requirements are met.