1. Fund Management Company in DIFC

Dubai International Financial Center (DIFC) is a purpose-built financial free-zone, located within the Emirate of Dubai. DIFC offers license to carry out wide range of financial and non-financial business activities. Financial business activities are regulated by a special regulatory body called the Dubai Financial Services Authority (DFSA). Any person who wishes to conduct a business in DIFC has to register a legal entity/body corporate under DIFC rules and regulations, and if the business is regulated under DFSA, then such legal entity is also required to get a special license from DFSA.

Fund Management Company in DIFC, also legally called as “Managing a Collective Investment Fund”, can be carried out by a licensed Fund Manager, who is legally accountable to the Unitholders for the management of the Fund, including the property held for or within the Fund, and who establishes, manages, or otherwise operates or winds up the Fund. Managing a Collective Investment Fund falls under Category 3C license of DFSA. Fund Manager license also includes the financial service of ‘Managing Assets’ in respect of the Fund. However, a business of “Managing Assets” is also available as a separate license.

The term ‘Asset Manager’ (alternatively referred to as ‘Investment Manager’) is the person who manages the assets of a fund or other portfolios on a discretionary basis. A person who performs this financial service in the DIFC must obtain from the DFSA the regulatory permission of ‘Managing Assets’. Note, however, that a person who performs the financial service of ‘Managing Assets’ is not, by virtue of this permission, a Fund Manager. Specific authorisation requirements, procedures and ongoing obligations, including a higher base capital requirement, apply to Asset Managers.

The Fund Management activity in DIFC can be conducted either by a Domestic Fund Manager or External Fund Manager.

The distinction between the Domestic Fund Manager and the External Fund Manager is as below:

- Domestic Fund Manager is a Fund Manager who is incorporated in the DIFC and is licensed and regulated by the DFSA to provide the financial service of managing either Domestic Funds or External Funds.

- External Fund Managers is a Foreign Fund Manager who is permitted to establish and manage a Domestic Fund in the DIFC without establishing a place of business in the DIFC. The External Fund Manager must be subject to regulation by a Financial Services Regulator in a Recognised Jurisdiction (as defined by the DFSA) and subject itself to the DIFC laws and jurisdiction of the DIFC courts. The External Fund Manager must appoint a Fund Administrator or Trustee based in the DIFC to act as its agent in its dealings with the DFSA, Unitholders, and prospective Unitholders.

2. Types of Fund Structures in DIFC

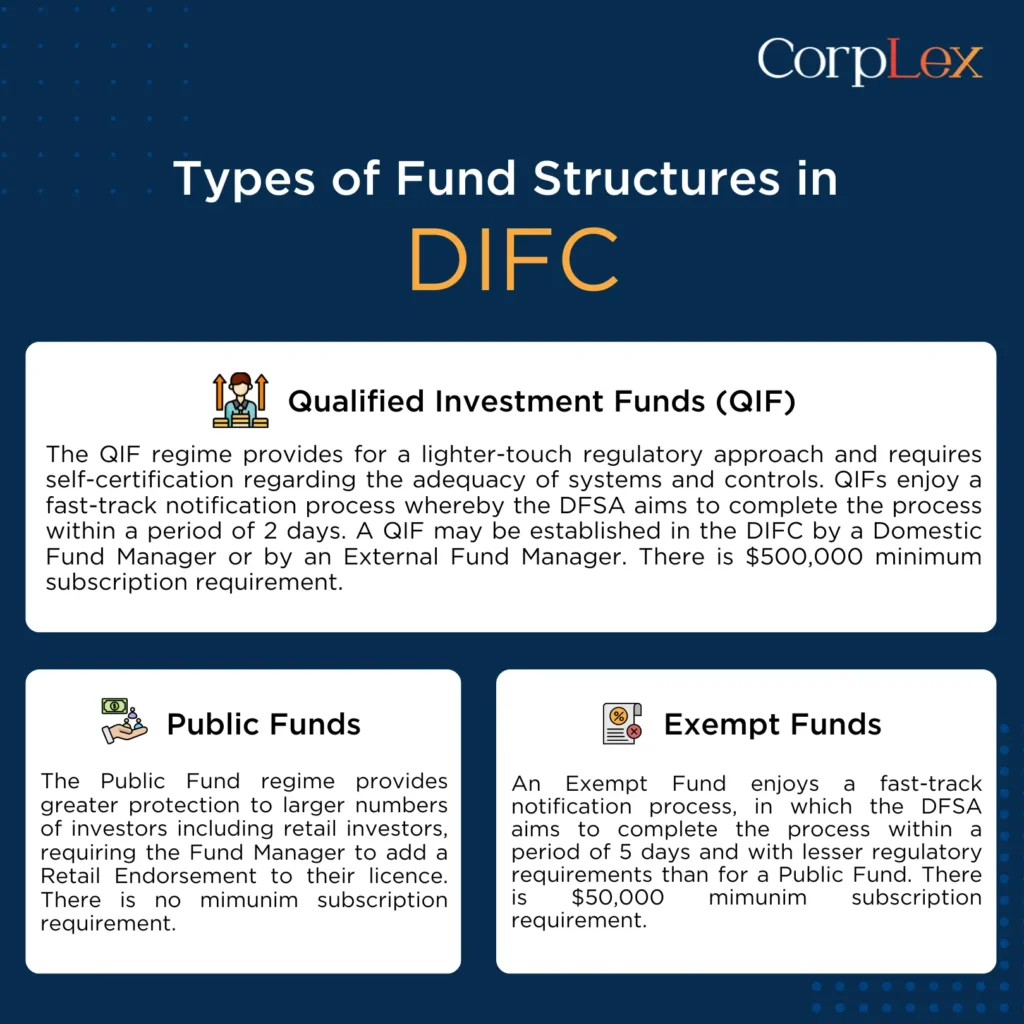

There are several types of Domestic Funds, including Public Funds, Exempt Funds, and Qualified Investor Funds (“QIF”), which are defined as below.

- Public Funds: The Public Fund regime provides greater protection to larger numbers of investors including retail investors, requiring the Fund Manager to add a Retail Endorsement to their licence. There is no minimum subscription requirement.

- Exempt Funds: An Exempt Fund enjoys a fast-track notification process, in which the DFSA aims to complete the process within a period of 5 days and with lesser regulatory requirements than for a Public Fund. There is $50,000 minimum subscription requirement.

- Qualified Investment Funds (QIF): The QIF regime provides for a lighter-touch regulatory approach and requires self-certification regarding the adequacy of systems and controls. QIFs enjoy a fast-track notification process whereby the DFSA aims to complete the process within a period of 2 days. A QIF may be established in the DIFC by a Domestic Fund Manager or by an External Fund Manager. There is $500,000 minimum subscription requirement.

DIFC also allows Fund Managers to setup specialist funds including Islamic Funds, Feeder Funds, Master Funds, Private Equity Funds, Property Funds, REITs, Hedge Funds, Umbrella Funds, Money Market Funds, ETFs, Venture Capital Funds and others. We can advise in case more information is required about each Fund.

Three types of Fund vehicles can be used to establish a Domestic Fund in the DIFC, namely Investment Companies, Investment Trusts and Investment Partnerships.

Interested in Fund Management in ADGM Instead?

If you’re looking to learn about setting up a fund management business in the ADGM, click here to read our detailed guide on Fund Management in ADGM.

3. Fees and Costs of Establishing a Fund Management Business

There are two sides to consider while calculating the costs of establishing the Domestic Funds Manager entity. First side is the fees paid to DIFC authority for incorporating the legal entity and the second side is the fees paid to DFSA for the regulatory approval.

DIFC fees for incorporating the entity include below:

| Description | Incorporation Costs (USD) |

| Name reservation fee (one-time) | $800 |

| Incorporation fees (one-time) | $8,000 |

| Commercial license fees (annual) | $12,000 |

| Establishment card fee (annual) | $618 |

| Personnel sponsorship agreement deposit | $680 |

| Data protection fee (annual) | $1,250 |

Certain discounts are available based on the Fund type and structure.

DFSA fees for a Fund Manager license vary between $2,000 to $25,000 based on the type of Fund. DFSA fees are usually paid annually.

DFSA also charges fees for each Fund setup between $1,000 to $4,000 per annum.

4. Capital Requirements for Fund Managers

Actual capital required for Fund Manager will depend on the nature, quantum of business and forecasted annual expenditure, as per the financial model of the proposed firm. Below are indicative capital requirements based on the type of Funds to be managed.

| Fund Manager Capacity | Base Capital Requirement (BCR) | Expenditure Base Capital Minimum (EBCM)* fraction | Capital Requirement |

| Fund Manager that manages any Public Fund or Credit Fund (whether or not it also manages other types of Funds) | $140,000 | 13/52 weeks | Higher of BCR (i.e. $140,000) or EBCM |

| Fund Manager managing a QIF and/or Exempt Fund only | $70,000 | 13/52 weeks | Higher of BCR (i.e. $70,000) or EBCM |

| Fund Manager managing Venture Capital Funds only | Nil | Nil | The DFSA will require a Fund Manager of a Venture Capital Fund to maintain sufficient liquid assets and access to financial resources that enable them to meet their obligations as they fall due, based upon the nature, size and complexity of their business. |

| Fund Manager who is also Licensed to Manage Assets of other portfolios | $500,000 | 13/52 weeks | Higher of BCR (i.e. $500,000) or EBCM |

* Fund Managers are required to maintain expenditure-based capital equal to their 13 weeks expenses.

5. Office Rent

Every entity registered in the DIFC is required to lease a physical office. The rent varies based on the building and location. To give you an idea, below are the fees for renting an office in DIFC per year.

| Office Type | Annual Rent |

| DIFC Business Centre Flexi Office (2 desks) | from $35,000 per year |

| DIFC Fitted Offices | from $600 per sq.m per year (subject to availability) |

| Other buildings in DIFC | from US$ 50,000 per annum (subject to availability) |

6. Requirements

To obtain a DFSA Licence, the proposed Fund Manager needs to demonstrate to the DFSA that:

- It has adequate systems and controls to manage the type of Fund it proposes to establish; and

- The individuals performing certain functions within the firm, such as its Board members, senior management and key control functions (e.g. compliance) meet the relevant suitability and integrity criteria.

The required appointments include Board of Directors, Senior Executive Officer, Finance Officer, Risk Officer, Compliance and AML Officer, and an internal and external Auditor. Some of the roles can be outsourced to professional firms in the UAE.

Once entity has been granted a Licence, the DFSA will supervise on an on-going basis, your activities which relate to the Funds you manage.

7. Process and Timelines

The DIFC application process commences with an application to setup a company to the DIFC and the DFSA.

The next step is to have the introductory call with the authority, following which a short-form Regulatory Business Plan (RBP) has to be provided, along with financial projections, for a quick review by the regulator.

The RBP has to be updated based on the comments from the regulator, and full required documentation including policies, processes along with the KYC and associated forms of all key individuals have to be prepared.

The formal application is then sent to the DFSA, who reviews the pack over a period of 7-10 business days, and then accepts it. The detailed review process then commences, and this can take anywhere between 20-30 business days to complete.

The regulator may revert back to the applicant with additional clarifications or requirements during the review process. The DFSA also meets with the SEO, FO and CO/MLRO designates, and conducts a detailed interview with them.

In case the application satisfies the DFSA requirements, DFSA issues in-principle approval. The applicant then proceeds with further steps of establishing the legal entity under DIFC, renting an office within DIFC, opening a bank account, and depositing the share capital in the account. This process can take anywhere between 30-45 business days on average. Other steps including residency visas for team members, appointment of auditors and obtaining professional indemnity insurance for the firm will follow after the setup.

Once the legal entity is formed and the final requirements are satisfied, a final submission is made to the DFSA to issue the Financial Service Permissions. Once the Financial Service Permissions is issued, the process is complete and the firm can commence its services.

Contact us today to learn how we can set up your fund management business in DIFC.

Disclaimer: The content on this page is for general information purposes only and does not constitute as legal advice nor should it be used as a basis for any specific action or decision. Nothing on this page is to be considered as creating a lawyer-client relationship or as rendering of legal advice or legal services for any specific matter. Users of this website are advised to seek specific legal advice from their lawyer or a legal counsel regarding any specific legal issues.