1. Introduction

This article will serve as a general guide to understanding the various types of companies in ADGM, helping you determine the most appropriate structure for your business objectives, whether you are a startup founder, an investor, or an established company expanding into the UAE market. Before exploring these structures in detail, it’s important to understand the environment in which they operate the Abu Dhabi Global Market.

Abu Dhabi Global Market (ADGM) is a leading international financial center located on Al Maryah and Reem Islands in Abu Dhabi, the capital of the United Arab Emirates. It offers a modern, innovative, and highly supportive environment for businesses, making it the ideal location for them. This financial center provides comprehensive support to entrepreneurs, investors, and global companies, helping them establish, develop, and grow their businesses with confidence.

ADGM reinforces Abu Dhabi’s position as a leading financial center and a strategic business hub connecting the economies of many regions, such as the Middle East, Africa, South Asia, and the rest of the world. ADGM operates within an international regulatory framework based on the direct application of English common law. ADGM’s jurisdiction extends to Al Maryah and Reem Islands, which are jointly designated as a financial free zone for the Emirate of Abu Dhabi.

ADGM is ranked as one of the most prominent and preferred international financial centers in the Middle East and Africa. Its advanced and comprehensive economic ecosystem fosters growth, resilience, and optimism for financial and non-financial institutions from around the world. The growing collaboration between Abu Dhabi Global Market (ADGM) and various jurisdictions has cemented its position as one of the most diverse and advanced financial centers in the world in terms of governance.

Established in 2013 by federal decree as an international financial center and free zone in the UAE, ADGM is an integral part of the Abu Dhabi Economic Vision 2030. ADGM operates under its own commercial and civil laws, ensuring a business-friendly environment. If you are considering setting up a company in this business hub, this article will provide you with comprehensive information about types of companies in ADGM and everything related to it.

Want a step-by-step overview of how to start your business in ADGM?

Read our Ultimate Guide to ADGM Company Setup for complete insights.

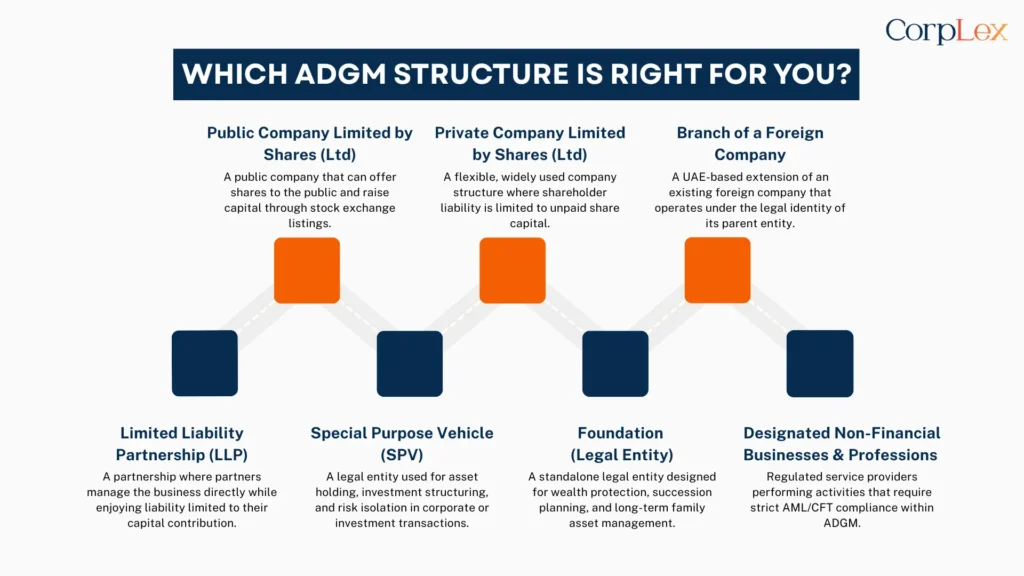

2. Overview of Legal Structures in ADGM

Abu Dhabi Global Market (ADGM) offers a diverse range of legal structures designed to suit every business owner and investment type. Whether you are a startup seeking support, an asset management company, an international company seeking expansion, or someone looking to establish a family office, ADGM has everything you need to provide a suitable and specialized framework to meet the unique needs of each business. Each business has a different legal form, unique regulatory requirements, varying rules and regulations, and varying flexibility, all of which provide entrepreneurs and investors with a variety of options to choose from.

The types of companies in ADGM are structured to support multiple industries and investment activities under a transparent and secure legal framework.

3. Breakdown of Each Company Type in ADGM

a. Public Company Limited by Shares (Ltd)

Public Company Limited by Shares (Ltd) is a public company that can offer its shares to the public, and potentially be listed on a stock exchange. Unlike a private limited company, it has fewer restrictions on its size and is a common structure for raising capital from the public. Liability is limited to the amount unpaid on shares, protecting members’ personal assets from company debts.

a. Private Company Limited by Shares (Ltd)

This is the most common type of company found and adopted in the Abu Dhabi Global Market, as it is considered most suitable for both operational and commercial companies. One of its most important advantages is that it allows shareholders to limit their liability based on the amount unpaid on their shares. In addition, it features flexible ownership, ease of management, and adheres to a globally recognized legal framework, making it suitable for startups, small and medium-sized enterprises, and holding entities. This form is one of the most popular among the types of companies in ADGM.

b. Branch of a Foreign Company

As for opening a branch, this is suitable for global and international companies wishing to establish a presence in the Abu Dhabi Global Market. They can use their name, license, and other necessary facilities without having to establish a new legal entity from scratch. This type of company (branch) is ideal for foreign companies operating as offshore companies that wish to expand their presence in the UAE market. However, the company must operate under the legal identity of the primary parent company and must therefore adhere to all its reporting and compliance obligations with all ADGM requirements.

c. Limited Liability Partnership (LLP)

When it comes to the Limited Liability Partnership (LLP), this type of partnership is ideal for businesses that provide professional services, such as law firms, consulting firms, accounting firms, marketing companies, and others. It provides limited liability to partners, enabling them to directly manage the business. Each partner’s liability is limited to their contribution, thus combining flexibility with protection. LLPs are among the recognized legal entities in ADGM for professional services.

d. Special Purpose Vehicle (SPV)

As for special purpose vehicles (SPVs), they are used for asset ownership, investment structuring transactions, and intellectual property rights. These types of companies prefer to use SPVs due to their simplicity, tax-efficiency advantages, and flexibility with regard to assets and even in isolating corporate risks. The most common uses of SPVs are real estate investment companies and corporate restructuring operations. SPVs remain one of the most flexible ADGM company structures for investors.

Explore the full process, requirements, and benefits in our next article:

Setting Up a Special Purpose Vehicle (SPV) in ADGM: A Complete Guide

e. Foundations

A foundation is a unique and distinctive structure used for private wealth management, family offices, or succession planning. It has a separate legal personality and is governed by a board of directors, providing strong asset protection and precise control, helping to preserve wealth and funds over the long term. It is also one of the most preferred types of companies in ADGM for family business continuity.

Ready to secure your assets and manage your wealth efficiently?

Get expert advice in our guide: 5 Key Tips for Setting Up an ADGM Foundation You Should Know

f. Designated Non-Financial Businesses & Professions (DNFBP)

In the case of DNFBP, this category includes certain fully regulated professional service providers, such as those providing legal services (legal advisors, real estate brokers and intermediaries), or those providing corporate services. All of these entities, regardless of their status, must adhere to and comply with the regulations issued by the Abu Dhabi Global Market, such as those related to anti-money laundering and terrorist financing, and particularly those related to financial transparency and ethical operating practices in the markets.

4. How to Choose the Right Structure

| Structure Type | Best For | Key Advantage | Considerations |

| Public Company (Ltd) | Raising capital from the public | No limit on the number of shareholders | Needs Board of Directors and shareholders |

| Private Company (Ltd) | Operational or trading businesses | Flexible and widely recognized | Needs directors and shareholders |

| Branch | Foreign and international companies expanding into UAE | No new legal entity | It’s operating under parent company liability |

| LLP | Professional partnerships | Shared management with limited liability | Can be the best for companies which based on firms |

| SPV | Asset holding and investments | Tax-efficient and as it’s simple and flexible | The operational scope is limited |

| Foundation | Family companies, wealth or legacy planning | Protection of strong asset | Governance requirements |

| DNFBP | Regulated professional services | Access to ADGM’s ecosystem | Strict compliance obligations |

This comparison can help entrepreneurs and investors evaluate the different types of companies in ADGM and select the most suitable structure for their business goals.

5. Expert Tip / CTA

Choosing the right corporate structure in the Abu Dhabi Global Market (ADGM) is a critical process that can have a significant impact on the efficiency and growth of your business. Each corporate structure has its own distinct advantages and compliance requirements, but choosing the best option generally depends on the company’s long-term goals, the sector in which it operates, and the ownership structure.

Golden Tip: Don’t make such a major decision without consulting a company formation expert in ADGM to ensure your company structure aligns with your long-term strategic goals and growth plans.

Need help choosing your corporate structure in the ADGM?

Contact our Corplex team for advice that will help you shape your future.

Faqs

-

What types of companies can I set up in ADGM?

ADGM offers several structures including Public Company Limited by Shares, Private Company Limited by Shares, Branch of a Foreign Company, Limited Liability Partnership (LLP), Special Purpose Vehicle (SPV), Foundations, and DNFBPs. Each structure serves different business needs based on ownership, risk, and operational requirements.

-

Which company structure is best for startups in ADGM?

The Private Company Limited by Shares (Ltd) is the most suitable for startups. It offers flexible ownership, limited liability, simple governance, and global legal familiarity—ideal for SMEs, holding entities, and operational companies.

-

What is the main advantage of setting up an SPV in ADGM?

SPVs in ADGM are popular for asset holding, investment structuring, and IP ownership. They offer tax efficiency, simplicity, low maintenance, and strong risk isolation, making them a top choice for real estate investors and corporate restructuring.

-

Can a foreign company open a branch in ADGM?

Yes. ADGM allows foreign companies to establish a branch without forming a new legal entity. The branch operates under the parent company’s legal identity and must comply with ADGM’s reporting and regulatory rules.

-

How do I choose the right ADGM company structure for my business?

The right structure depends on your business activity, ownership model, risk exposure, and long-term goals. Public companies suit capital-raising, LLPs suit professional firms, SPVs suit asset holding, and foundations suit wealth management. Consulting an ADGM company formation expert is strongly recommended.