1. Introduction: Overview of ADGM and its significance.

As a business owner, there are many factors that matters and you look forward before setting up your company, such as the tax rate, 100% ownership of the business, reputation of the jurisdiction, flexibility of legal system, lack of currency restrictions, and 100% repatriation of capital and tax. Abu Dhabi Global Market (ADGM) is one of the free zones in the UAE that provides a unique business ecosystem based on English common laws with its own court system. This blog will guide you on a complete guide on ADGM Company Setup.

ADGM is an international financial centre established in 2013, located in Abu Dhabi, the capital of the United Arab Emirates. It operates under it own set of laws and regulations based on English common laws that is separate from the UAE system, and serves as a financial institution, with it’s fintech, tax efficient and business friendly environment.

2. Benefits of ADGM Company Setup:

There are several benefits why you can consider if you will setup your company with ADGM:

- ADGM is located in the heart of Abu Dhabi in across Al Maryah Island and Al Reem Island

- In ADGM, there are no restrictions related to foreign ownership, foreign employees, and capital.

- It follows the independent common law judicial system, with English as the main language.

- It includes high class auditing firms, banks, financial institutions and other professional services.

- It is location in Abu Dhabi, which plays a significant role on the trade between Asia, Africa and Europe.

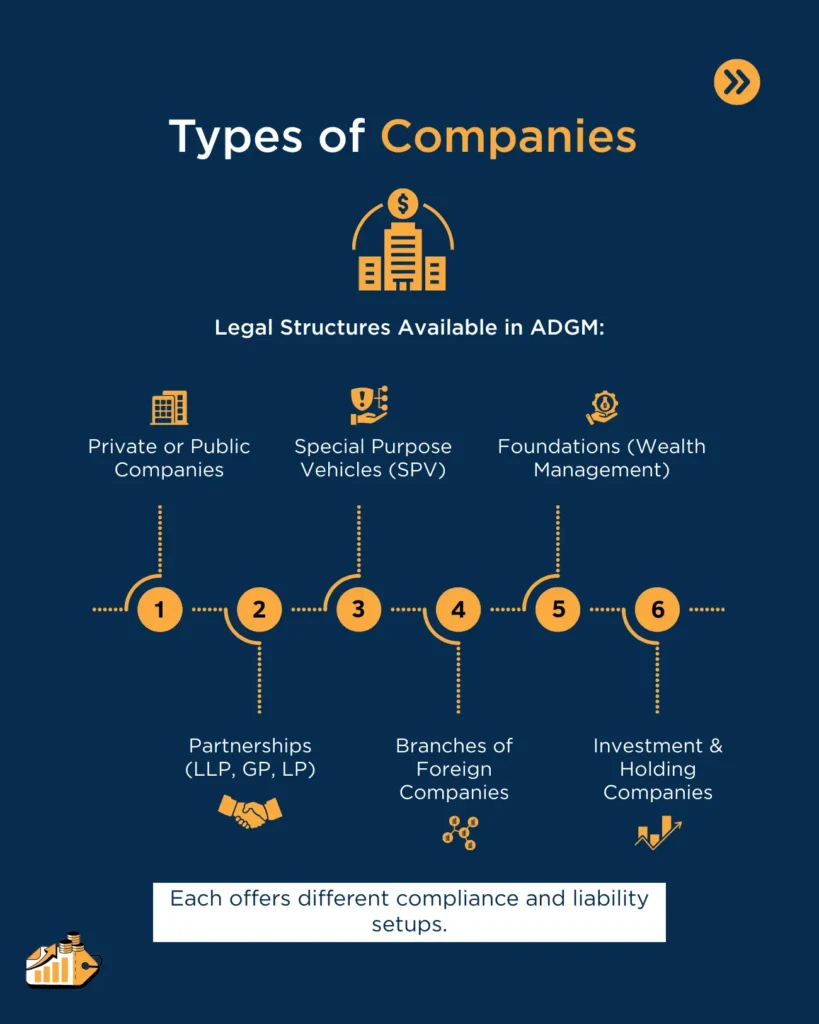

3. Types of Legal Entities in ADGM:

To be able to understand the requirements, and characteristics for each entity type is a crucial step for entrepreneurs to set their ADGM company setup on the right track. ADGM allows company owners to have a variety of legal structures that are suitable with different goals, such as:

Company Types in ADGM:

In general, the companies can be limited or unlimited, whereas in the limited company the member’s liability is limited by its constitution. It may be limited by shares or limited by guarantee. Further, the companies can be private and public companies. Based on these distinctions, the following types of companies exist:

- Public Company Limited by Shares: Public CLS can be established with at least two shareholders (one individual) with minimum share capital of USD 50,000. Public Company Limited by Shares can offer shares to the public. Liability of the shareholder is limited.

- Private Company Limited by Shares: Private CLS thatcan be established with at least one individual shareholder and one director without minimum share capital requirement. Private Company Limited by Shares can not offer shares to the public. Liability of the shareholder is limited.

- Private Company Limited by Guarantee: Private CLG does not distribute profits or divide assets into shares. It requires one guarantor and one director, with no minimum share capital or secretary requirement.

- Restricted Scope Company: Such structure requires lighter compliance (e.g., family offices), and allows limited public disclosure. It can only be formed under specific conditions, such as being a subsidiary of a publicly filing group , or as a subsidiary of a company formed by Emiri decree or by an individual/members of the same family.

- Private Company Unlimited with or without Shares: Unlimited companies do not restrict shareholder liability. The other requirements are similar to Private Company Limited by Shares.

- Branch of a Foreign Company: Foreign companies can establish a branch at ADGM through branch license. This requires an appointment of the branch’s authorized signatory.

Want to compare all available structures? Visit our detailed overview: Types of Companies in ADGM.

Partnership Types in ADGM:

- Limited Liability Partnership (LLP): Ideal for professionals like accountants and lawyers, this structure provides limited liability for each partner and sheilds partners from liability incurred by the other partners while working together. LLP requires at least two partners and one authorized signatory/manager.

- General Partnership: GP does not provide limited liablity protection and thus the partners share unlimited liability for business obligations, unlike LLP. GP can be established by minimum two partners and one authorized signatory/manager.

- Limited Partnership: In LP structure one or more of the partners is liable only to the amount he has invested. This structure balances liability protection and investment flexibility. LP can be established by two partners (one general, one limited) and one authorized signatory/manager.

- Branch of Foreign Partnership: Foreign partnerships can establish their branches in ADGM. This requires an appointment of the branch’s authorized signatory.

Specialized Entities in ADGM:

- Protected Cell Company (PCC): PCC is a legal entity which is comprised of a core and several cells with separate assets and liabilities. This is ideal for limitation of risks as it allows segregation of assets and liabilities across individual cells. They can be set up as Public or Private Limited Companies.

- Incorporated Cell Company (ICC): Unlike PCCs, ICCs treat each cell as a distinct legal entity without shareholder relationships between cells and the parent company. They can be set up as Public or Private Limited Companies.

- Investment Company: Engaged in pooled capital investments, these entities can take forms such as PLCs, LTDs, or Private Unlimited Companies.

Special Purpose Vehicles (SPV) in ADGM:

Special Purpose Vehicles (SPV): ADGM’s SPV Regime is designed to cater to a broad range of business types, uses and industry sectors. These include corporates, financial institutions, sovereign wealth funds, family offices and individual investors. ADGM SPVs are corporate vehicles, used for a variety of purposes, including to establish subsidiaries, project or joint venture vehicles. The key feature of an SPV is its separate legal personality, enabling the isolation of financial and legal risk from the assets and liabilities of the SPV’s shareholders or any of its sister companies. In ADGM, an SPV is incorporated either as: a Private Company Limited by Shares and licensed to conduct SPV activities; or a Restricted Scope Company (RSC), which allows for more limited disclosure on the public register.

Want the full setup roadmap? Check out Setting Up a Special Purpose Vehicle (SPV) in ADGM: A Complete Guide.

Foundations in ADGM:

Foundations: Foundations, like trusts, are used for a variety of purposes including wealth management and estate planning. Unlike trusts, however, Foundations are incorporated as a legal entity with their own legal personality and can hold assets in its own name on behalf of beneficiaries. Foundations are similar to companies but without shareholders, making them suitable for wealth management across generations. ADGM foundations support local and international families and High Net Worth Individuals to efficiently manage their business and investment interests across multiple generations.

However, unlike a company, a foundation cannot carry out commercial activities, other than those necessary, ancillary or incidental to its purposes.

Don’t miss our expert guide: 5 Tips for Setting Up an ADGM Foundation. Learn about exempt vs non-exempt, roles, documentation & more.

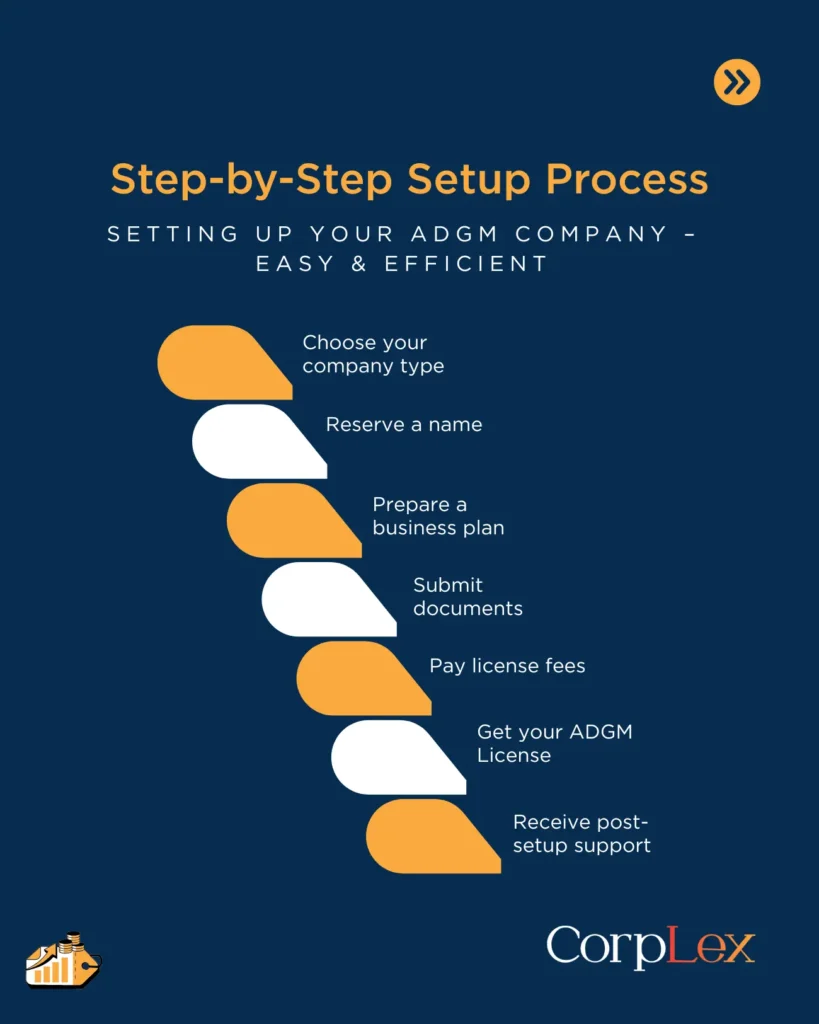

4. Step-by-Step Setup Process:

To establish a company with ADGM, the ADGM company setup process is easy and simple as follows:

- Choosing the company’s type

It is crucial to get an expert’s advise on what company type is more suitable for your business activity and goals.

- Reserving the company’s name

Most common names are allowed to use with ADGM, unless there are specific rules regarding the names as follows:

- The name cannot be used by an existing company with ADGM.

- The name cannot include any sensitive, offensive or prohibited name by the regulations of ADGM.

- Preparing the business plan

The company needs to prepare a proper business plan that includes all the necessary information such as the business activities, market analysis, target market, overall business strategy, and the financial projects.

- Submitting the required documents

The requirements to set up a company with ADGM differs from a business to business depending on the activity and license type, these requirements can be having a physical office, appointing a secretary, and meeting the minimum share capital requirements.

- Payment

After submitting the requirements, the payment must be done in order to issue the license fees.

- Getting the license

After the payment, and submitting all the required documents and being approved by the ADGM Registration Authority, which will mean that the company is legally recognised and can operate with ADGM.

- Post Set-up support

After the ADGM company setup, the service provider will keep contacting you for additional assistance regarding operating the company, or any other assistance needed.

5. Requirements for setting up a company with ADGM:

To complete your ADGM company setup, there are some documents that are required only depending on the company’s type, but here are the main general requirements for most legal entities with ADGM:

- Business plan: which is the fundamental for the application process, and will work as a tool to show the ADGM Authority the applicant’s willingness, goals, ability to meet the conditions, or to conduct business activities from and within ADGM. It should include an overview over the business’s history or applicant’s experience, in addition to the business activities to be conducted and the target market.

- The name of the company: which should be unique and available, and representing the activity of a company.

- Articles of Association Draft: ADGM provides a ready template for the AOA, but it can be amended or the applicant can provide their own draft of AOA, that is compliant with ADGM companies regulations.

- Registered office address: Which must be located in Al Maryah Island or Al Reem Island.

- Signatories Details: Which must be an individual ((Individuals who never entered the UAE cannot be appointed as authorized signatories).

- Shareholders: Can be an individual or a body corporate, if the shareholder is an individual, some basic requirements are the personal details, passport copies (for current and previous nationalities), proof of residential address, Evidence of appointment documents (which template can be found in ADGM website). If the shareholder is a body corporate some basic requirements are the Entity details, address, Certificate of Incorporation- Registration, recent Register of members, Register of Directors, Evidence of appointment documents (which template can be found in ADGM website).

- Ultimate Beneficial Owners: Details should be provided if one of the shareholders owns more than 25% or more of the company.

- Anti Money Laundering Manual and Money Laundering Reporting Officer: which is applicable if the company will conduct certain activities such as, real estate developer or agency, law firm, notary firm, accounting firm, Company Service Provider, and other independent legal businesses.

6. Cost Overview:

The ADGM company setupcost is divided into 3 categories, which depends on the following business activity:

- Category A: Financial Services – $17,000, with a cost breakdown as below:

Name Reservation – $200

Application for Incorporation – $300

Commercial Licence Fee – $200

Business Activity Fee – $16,000

Data Protection Fee – $300

Financial services activities also require approval from Financial Services Regulatory Authority (FSRA) which has its own license fees and minimum capital requirement. FSRA fees depend largely on the business activity type.

- Category B: Non-Financial Services – $5,800, with a cost breakdown as below:

Name Reservation – $200

Application for Incorporation – $300

Commercial Licence Fee – $200

Business Activity Fee – $4,800

Data Protection Fee – $300

- Category C: Retail – $2,800, with a cost breakdown as below:

Name Reservation – $200

Application for Incorporation – $300

Commercial Licence Fee – $200

Business Activity Fee – $1,800

Data Protection Fee – $300

- Tech Start Up – $1,500

- Special Purpose Vehicle (SPV)- $1,900, with a cost breakdown as below:

Name Reservation – $200

Application for Incorporation – $300

Commercial Licence Fee – $200

Business Activity Fee – $900

Data Protection Fee – $300

- Open / Closed Ended Investment Co. – $1,900, with a cost breakdown as below:

Name Reservation – $200

Application for Incorporation – $300

Commercial Licence Fee – $200

Business Activity Fee – $900

Data Protection Fee – $300

- Foundation – $1,000, with a cost breakdown as below:

Name Reservation – $200

Application for Incorporation – $300

Commercial Licence Fee – $200

Business Activity Fee – $0

Data Protection Fee – $300

- Social Enterprises- $700, with a cost breakdown as below:

Subject to obtaining and maintaining a certificate/ approval confirming classification of the entity as a “Social Enterprise” from the competent Authority.

Apart from the above fees, there are additional fees to be incurred for renting an office or registered address, legal fees and services of the Company Service Providers (CSP).

How Corplex Can Help?

Creating a company with ADGM with the above-mentioned steps and requirements though is straightforward, yet it requires an extensive experience and experts guidance. At CorpLex, we are committed to deliver the high quality consultation and services. Whether it’s about starting a new venture or expanding your existing one, we are here to assist you in every step of your ADGM company setup.

Contact us today to learn how we can help you with ADGM company setup.

If you’re planning to set up a fund management company in ADGM, check out our detailed guide on ADGM fund management company setup for step-by-step insights and regulatory requirements.